Employee 401k match calculator

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even without matching the 401k can still make financial sense because of its tax benefits.

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

How do I maximize my employer 401k matchMany employees are not taking full advantage of their employers matching contributions.

. Employer 401k match types. If you earn 60000. Many employees are not taking full advantage of their employers matching contributions.

For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. Your employer matches 3 but you want to put in. When an employee has a set dollar amount they contribute to each week and the company default is 3 QuickBooks is not recognizing when.

If for example your contribution percentage is so. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. Its important to note that your contribution percentage and employer match percentage might be different for instance.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. How Matching Works. It provides you with two important advantages.

The JPMorgan Chase 401k Savings Plan match calculator is a tool for match-eligible employees. Youre eligible for match if you have completed one year of service and have Total. K Company Match Calculation.

Now a 401K contribution is determined by taking a percentage of your income rather than an amount of the income. For example if your employer matches up to 3 percent. There are numerous match types businesses may offer.

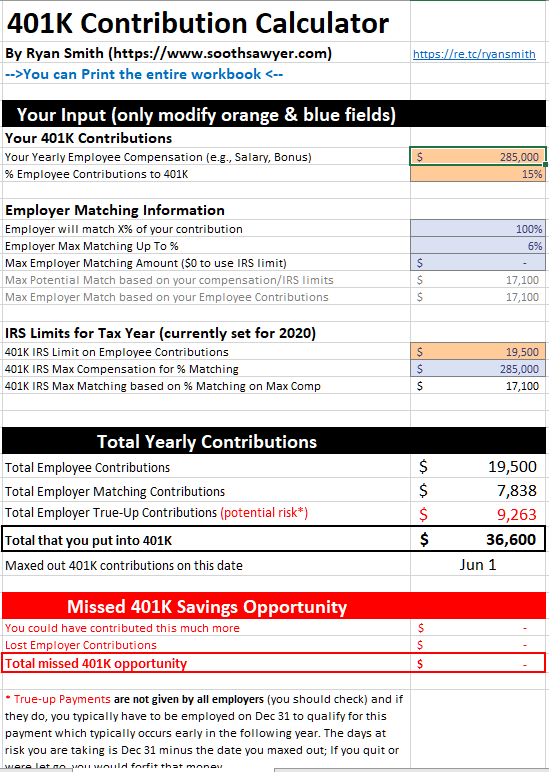

Ideally you want to spread out your contributions across the year while maxing out your employer matching to avoid True Up risks read more about this here This 401K calculator does all the. Lets go back to the 401k calculator. Assume your employer offers a 100 match on all your contributions each year up to a maximum of 3 of your annual income.

The benefit will be calculated as. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Apply your companys match percentage to your gross income for the contribution pay period. The annual elective deferral limit for a 401k plan in 2022 is 20500. 050 per dollar on the first 6 of pay.

The employer match helps you accelerate your retirement contributions. Of all Human Interest plans here are the most common formulas. A 401 k can be one of your best tools for creating a secure retirement.

First all contributions and earnings to your 401 k are tax deferred. This calculator assumes that your return is compounded annually and your deposits are made monthly. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages.

The actual rate of return is largely. That extra 6000 basically makes the calculation a no-brainer. In other words if you want to contribute 100month and.

100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to. The annual rate of return for your 401 k account. Find a Dedicated Financial Advisor Now.

Brought to you by Sapling. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. 100 per dollar on the first 3 of pay 050 per dollar on the next 2 of pay.

Do Your Investments Align with Your Goals. The most common formulas for 401 matching contributions are. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

What Is A Retirement Plan Retirement Planning How To Plan Investment Advice

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

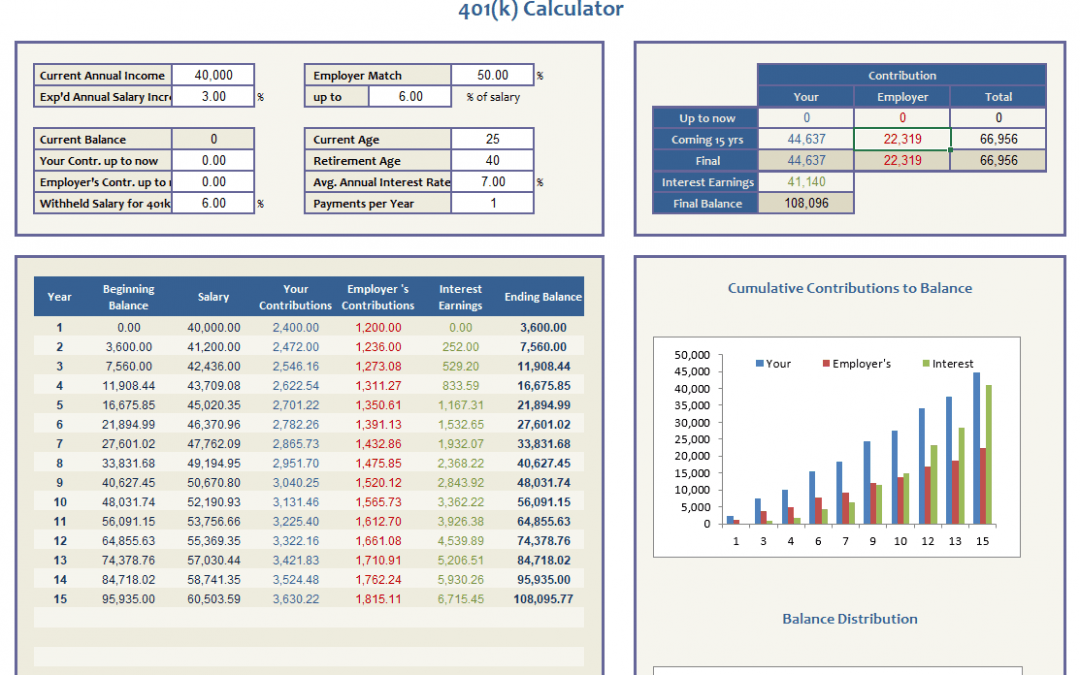

Free 401k Calculator For Excel Calculate Your 401k Savings

Customizable 401k Calculator And Retirement Analysis Template

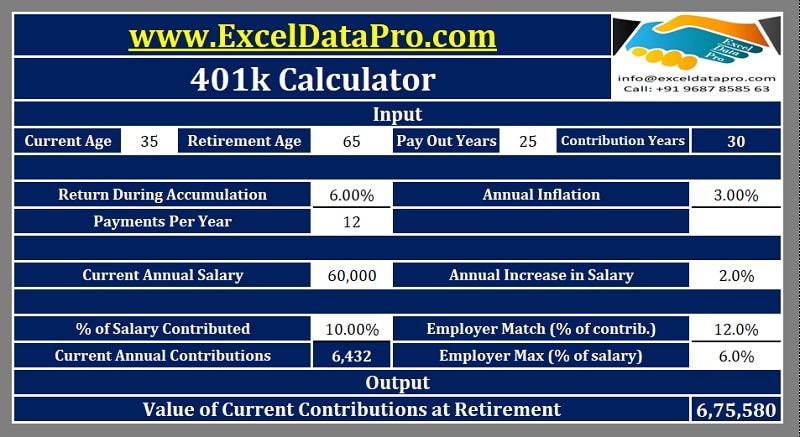

Download 401k Calculator Excel Template Exceldatapro

What Is A 401 K Match Onplane Financial Advisors

Retirement Services 401 K Calculator

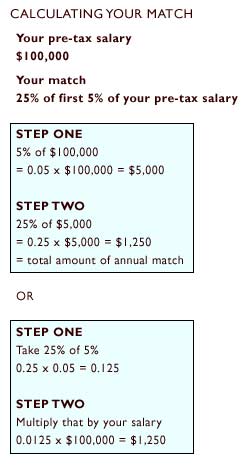

Doing The Math On Your 401 K Match Sep 29 2000

Investment Goals Investing Investing For Retirement Retirement Savings Plan

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

401k Contribution Limits And Rules 401k Investing Money How To Plan

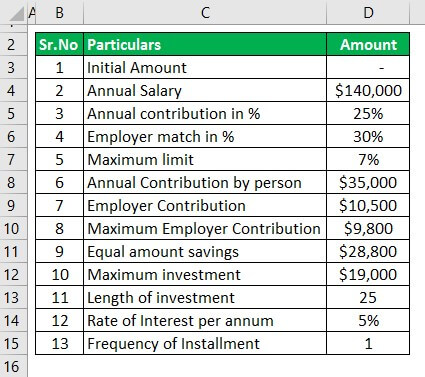

401k Contribution Calculator Step By Step Guide With Examples

Is Your Company S 5mm 401k Plan Paying More Than 1 25 All In Do You Even Know What You Re Paying We Can Help Https 401kspec 401k Plan How To Plan 401k

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

401 K Plan What Is A 401 K And How Does It Work

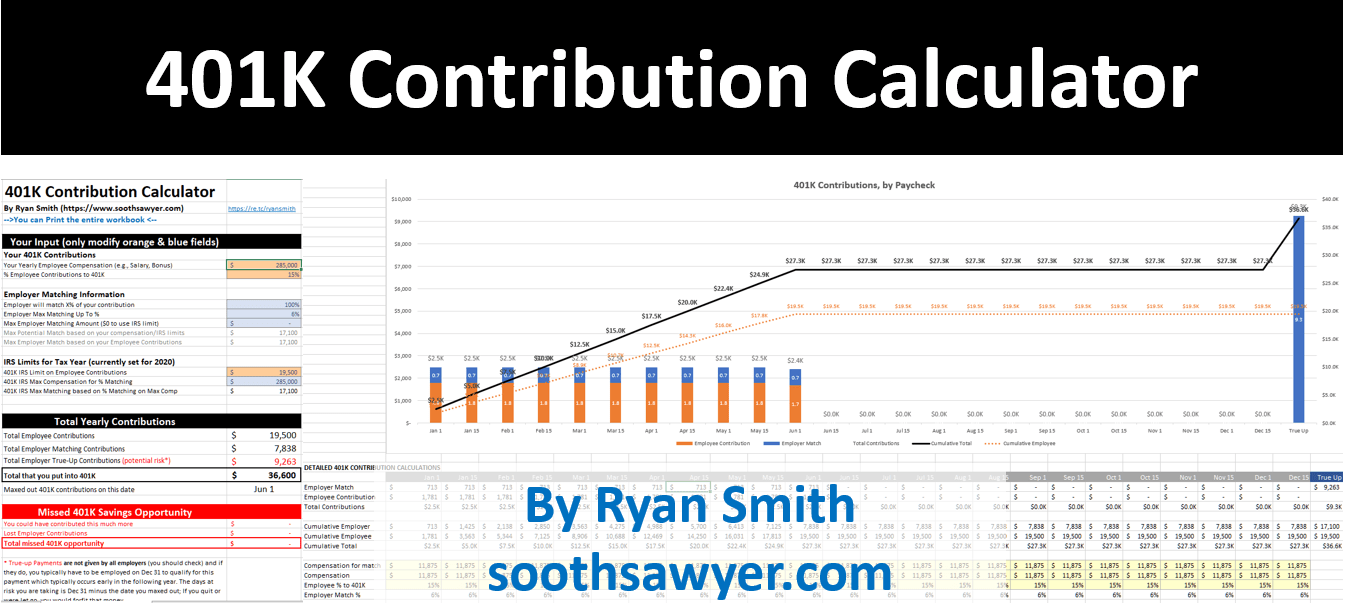

401k Employee Contribution Calculator Soothsawyer

401k Employee Contribution Calculator Soothsawyer